Best Personal Finance Tips for Beginners – Saving, Budgeting, and Becoming Debt-Free

Managing money effectively is one of the most important life skills anyone can develop. Yet, for many beginners, personal finance feels overwhelming, confusing, and even intimidating. Questions about saving, budgeting, debt repayment, investing, and financial security often arise without clear guidance on where to start.

The good news is that mastering personal finance does not require advanced mathematical skills or a background in economics. It requires discipline, clarity, consistency, and a willingness to build healthy financial habits over time. Whether you are a student, a young professional, a newly married couple, or simply someone who wants to take control of your money, the fundamentals remain the same.

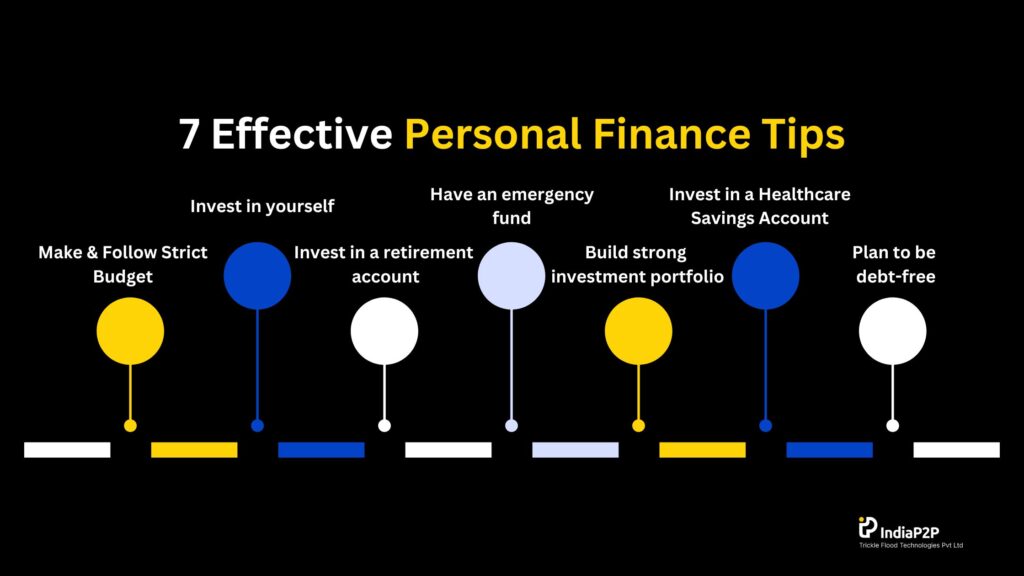

This comprehensive guide covers the best personal finance tips for beginners, focusing on saving strategies, practical budgeting methods, and effective debt-free plans. By the end, you will have a clear roadmap to build financial stability and long-term wealth.

Understanding the Foundations of Personal Finance

Before diving into strategies and techniques, it is important to understand what personal finance truly means. Personal finance refers to how you manage your money, including earning, saving, spending, investing, and protecting your financial resources.

At its core, personal finance revolves around five main pillars:

- Income

- Expenses

- Savings

- Debt

- Investments

For beginners, the primary focus should be on stabilizing income, controlling expenses, building savings, and eliminating debt. Investments typically come later, once a strong financial foundation is in place.

Financial success is rarely about earning the highest income. Many high-income earners struggle financially due to poor money management. Conversely, individuals with moderate incomes can achieve financial freedom by applying disciplined financial habits.

Step One: Gain Clarity About Your Financial Situation

The first and most important step toward financial control is awareness. You cannot improve what you do not measure.

Calculate Your Total Monthly Income

Start by identifying all sources of income:

- Salary (after taxes)

- Freelance or side income

- Business income

- Rental income

- Any other regular cash inflows

Focus on your net income, meaning the amount you actually receive after taxes and deductions. This is the amount you have available to allocate.

Track Your Monthly Expenses

Next, list all your expenses. Divide them into two categories:

Fixed Expenses:

- Rent or mortgage

- Utilities

- Insurance

- Loan payments

- Subscriptions

- School fees

Variable Expenses:

- Groceries

- Transportation

- Dining out

- Entertainment

- Shopping

- Personal care

Tracking expenses for at least one to three months provides a realistic picture of your spending patterns. Many beginners underestimate how much they spend on small, daily purchases. These minor expenses often accumulate into significant amounts over time.

Financial clarity eliminates guesswork and gives you a realistic starting point.

Creating a Practical Budget That Works

Budgeting is not about restricting yourself from enjoying life. It is about telling your money where to go instead of wondering where it went.

Choose a Budgeting Method

There are several effective budgeting methods suitable for beginners.

1. The 50/30/20 Rule

This simple framework divides your income into three categories:

- 50% for needs (housing, utilities, food, transportation)

- 30% for wants (entertainment, dining, hobbies)

- 20% for savings and debt repayment

This method works well for beginners who prefer simplicity and structure.

2. Zero-Based Budgeting

In zero-based budgeting, every dollar of income is assigned a purpose. Income minus expenses equals zero. This does not mean you spend everything; it means every dollar is allocated, whether to bills, savings, or investments.

This method encourages intentional spending and prevents money from sitting idle or being wasted.

3. Envelope System

This traditional method involves allocating cash into envelopes labeled for specific categories such as groceries, entertainment, and transportation. Once an envelope is empty, spending in that category stops.

The envelope system is particularly helpful for individuals who struggle with overspending.

Make Budgeting a Monthly Habit

A budget is not a one-time activity. Review and adjust your budget every month to reflect changes in income, expenses, and financial goals. Over time, budgeting becomes easier and more intuitive.

Building an Emergency Fund

One of the most crucial personal finance tips for beginners is to prioritize an emergency fund.

Life is unpredictable. Job loss, medical emergencies, car repairs, or unexpected home expenses can derail your finances if you are unprepared.

How Much Should You Save?

As a beginner, aim to save:

- $1,000 as a starter emergency fund

- Then gradually build up to 3–6 months of living expenses

This fund should be kept in a separate, easily accessible savings account. It is not for vacations, shopping, or investments. It is strictly for true emergencies.

An emergency fund provides peace of mind and prevents you from relying on credit cards or loans during difficult times.

Smart Saving Strategies for Beginners

Saving money is not about how much you earn. It is about how much you consistently set aside.

Pay Yourself First

Treat savings as a mandatory expense. When you receive your income, immediately transfer a predetermined amount to savings before paying other bills.

Automating this transfer makes saving effortless and consistent.

Start Small and Increase Gradually

If you cannot save 20% of your income, start with 5% or 10%. The key is consistency. As your income increases, increase your savings rate.

Cut Unnecessary Expenses

Review your spending for areas to reduce:

- Cancel unused subscriptions

- Cook more meals at home

- Limit impulse purchases

- Compare prices before buying

Small adjustments can free up significant amounts for savings.

Set Clear Financial Goals

Saving becomes easier when you have a purpose. Define short-term and long-term goals such as:

- Emergency fund

- Vacation fund

- Down payment on a house

- Education

- Retirement

Specific goals provide motivation and direction.

Understanding and Eliminating Debt

Debt can be one of the biggest obstacles to financial freedom. High-interest debt, especially credit card debt, can quickly spiral out of control.

Identify All Your Debts

List each debt with:

- Total balance

- Interest rate

- Minimum monthly payment

This gives you a clear understanding of your debt burden.

Debt Repayment Strategies

1. Debt Snowball Method

With this method, you pay off debts from smallest to largest balance, regardless of interest rate. You make minimum payments on all debts but put extra money toward the smallest one.

Once the smallest debt is paid off, you move to the next smallest.

This approach builds psychological momentum and motivation.

2. Debt Avalanche Method

Here, you prioritize debts with the highest interest rates first while making minimum payments on the others.

This method saves more money in interest over time.

Both strategies are effective. Choose the one that keeps you motivated and consistent.

Avoid Accumulating New Debt

While repaying debt:

- Stop using credit cards for unnecessary purchases

- Avoid taking new loans

- Build an emergency fund to prevent borrowing

Becoming debt-free is a major milestone in personal finance and significantly improves financial stability.

Developing Healthy Spending Habits

Financial success is built on daily habits.

Differentiate Between Needs and Wants

A need is essential for survival and basic functioning. A want enhances comfort or enjoyment.

Before making a purchase, ask yourself:

- Is this necessary?

- Can I afford it without using credit?

- Does it align with my financial goals?

This pause can prevent impulse spending.

Practice Delayed Gratification

Wait 24 to 48 hours before making non-essential purchases. Often, the urge to buy fades with time.

Delayed gratification strengthens financial discipline and helps you prioritize long-term goals over short-term pleasure.

Increasing Your Income

While budgeting and saving are important, increasing income accelerates financial progress.

Improve Your Skills

Invest in learning new skills that can increase your earning potential. This may include:

- Professional certifications

- Online courses

- Advanced education

- Technical skills

Higher skills often lead to higher income opportunities.

Start a Side Hustle

Consider:

- Freelancing

- Online business

- Tutoring

- Consulting

- Selling digital products

A side hustle can help you pay off debt faster and build savings more quickly.

Negotiate Your Salary

Many beginners underestimate the power of negotiation. Research industry standards and confidently request fair compensation based on your skills and performance.

Increasing income expands your financial flexibility and accelerates wealth building.

The Importance of Financial Goals

Without goals, money management lacks direction.

Short-Term Goals (1–2 Years)

- Build emergency fund

- Pay off small debts

- Save for a vacation

Medium-Term Goals (3–5 Years)

- Buy a car

- Save for a home down payment

- Start a business

Long-Term Goals (10+ Years)

- Retirement

- Financial independence

- Children’s education

Write down your goals and assign timelines and estimated costs. Review them regularly to stay focused.

Introduction to Investing for Beginners

Once you have:

- An emergency fund

- No high-interest debt

- A stable budget

You can begin investing.

Investing allows your money to grow over time through compound interest.

Start Early

The earlier you start investing, the more time your money has to grow. Even small amounts invested consistently can accumulate significantly over decades.

Understand Risk Tolerance

Risk tolerance refers to your ability to handle fluctuations in investment value. Younger individuals often have higher risk tolerance because they have more time to recover from market downturns.

Diversify Your Investments

Avoid putting all your money into one asset. Diversification reduces risk by spreading investments across:

- Stocks

- Bonds

- Mutual funds

- Index funds

- Real estate

Beginners often benefit from low-cost index funds due to their simplicity and diversification.

Retirement Planning for Beginners

Retirement may seem far away, but planning early makes a substantial difference.

Take Advantage of Employer Plans

If your employer offers a retirement plan with matching contributions, contribute at least enough to receive the full match. This is essentially free money.

Consistency Over Perfection

Regular contributions matter more than perfect timing. Invest consistently regardless of market conditions.

Retirement planning ensures long-term security and independence.

Protecting Your Finances

Building wealth is important, but protecting it is equally crucial.

Insurance

Ensure you have adequate:

- Health insurance

- Life insurance (if you have dependents)

- Disability insurance

- Property insurance

Insurance prevents financial disasters from wiping out years of savings.

Build Good Credit

A good credit score:

- Lowers borrowing costs

- Improves loan approval chances

- Provides better financial opportunities

Pay bills on time, maintain low credit utilization, and avoid unnecessary credit applications.

Avoiding Common Financial Mistakes

Beginners often fall into predictable traps.

Lifestyle Inflation

As income increases, many people increase spending proportionally. Instead, increase savings and investments while keeping lifestyle upgrades moderate.

Ignoring Small Expenses

Daily small purchases can accumulate into large monthly totals. Stay mindful of recurring costs.

Not Planning for Taxes

Freelancers and business owners must set aside money for taxes to avoid unexpected liabilities.

Delaying Financial Planning

The biggest mistake is postponing action. Even small steps taken today create meaningful progress.

Creating a Long-Term Financial Plan

Personal finance is not about quick fixes. It is about sustainable habits and long-term planning.

Review Finances Quarterly

Every three months:

- Review budget

- Assess savings progress

- Check debt balances

- Evaluate financial goals

Regular reviews keep you aligned with your objectives.

Adjust as Life Changes

Marriage, children, career shifts, and relocation require financial adjustments. Flexibility ensures resilience.

Building Financial Discipline

Financial discipline is developed, not inherited.

Create Systems

Automate:

- Savings transfers

- Bill payments

- Investment contributions

Systems reduce reliance on willpower.

Surround Yourself with Financially Responsible Influences

Read personal finance books, follow credible financial educators, and associate with individuals who value responsible money management.

Positive financial environments encourage better decisions.

The Psychology of Money

Personal finance is as much psychological as it is mathematical.

Your beliefs about money influence your behavior.

If you view money as stressful or scarce, you may avoid managing it. If you view it as a tool for freedom and security, you are more likely to manage it responsibly.

Develop a healthy money mindset by:

- Practicing gratitude

- Setting realistic expectations

- Avoiding comparison with others

- Celebrating financial milestones

Financial Independence and Long-Term Wealth

Financial independence means having enough assets to support your desired lifestyle without relying solely on active income.

Achieving this requires:

- Consistent saving

- Smart investing

- Controlled spending

- Debt elimination

- Long-term discipline

It is not achieved overnight, but through years of steady progress.

Final Thoughts

Personal finance for beginners does not have to be complicated. The most effective strategies are often the simplest:

- Spend less than you earn

- Save consistently

- Avoid unnecessary debt

- Invest for the long term

- Protect your assets

- Review and adjust regularly

Financial success is not determined by luck. It is built through consistent, disciplined actions taken over time.

Start where you are. Use what you have. Take one step today. Whether that step is creating your first budget, saving your first $100, or making an extra debt payment, progress begins with action.

Over time, these small decisions compound into financial stability, confidence, and freedom.